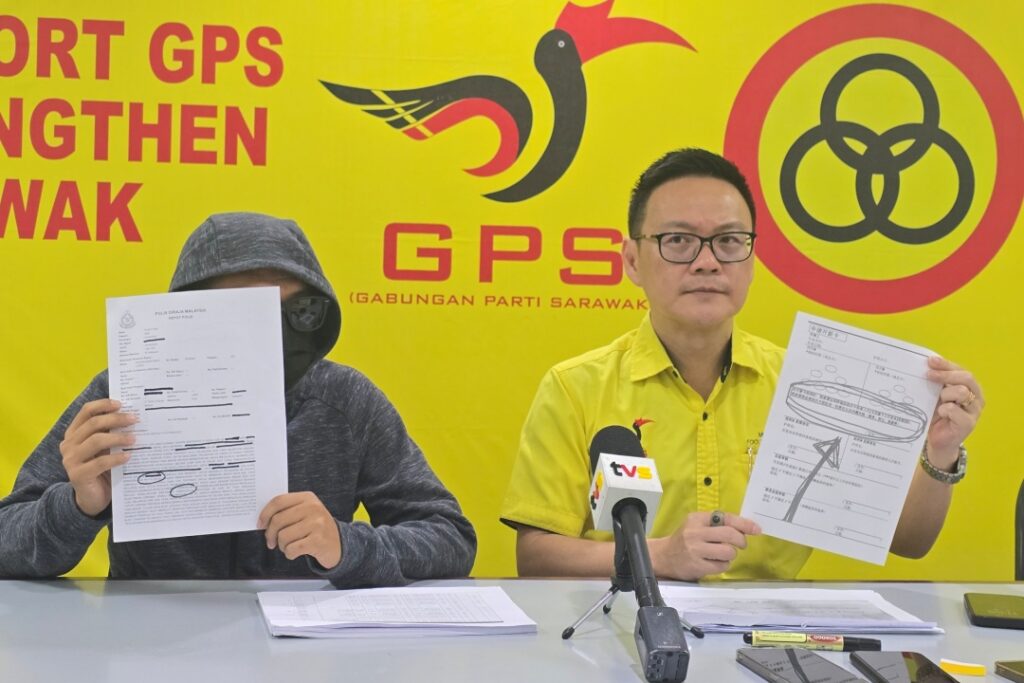

Foo shows the form meant for the MLM scheme, while the victim, on his right, shows the police report. — Photo by Galileo Petingi

KUCHING (Oct 18): A 32-year-old local businessman and four of his family members lost a total of RM750,000 to a pyramid scheme scam.

Sarawak United People’s Party (SUPP) Public Complaints Bureau chief Milton Foo said the whole ordeal began in August 2019 when the victim was introduced by a close family acquaintance to a multi-level marketing (MLM) investment scheme in China.

He, his brother and sister-in-law then travelled to Fangchenggang in Guangxi, China to learn more about the scheme, which involved investing in property and tourism – requiring an investment of 233, 831 Chinese renminbi (about RM150,000) per person.

“The promised return was a staggering 39 million renminbi (about RM23.1 million) for each of them – that’s more than 100-fold returns!

“And so, the three of them each invested RM150,000 shortly after their visit; and in October of the same year, his mother and another family member chipped in RM150,000 each – all totalling RM750,000.

“Payments were made through multiple bank accounts provided by the scammers, mostly via cash deposits with one credit card transaction; the banks did inquire about the source and purpose of the funds during the transactions to the bank accounts.

“However, last year they managed to lodge a police report after they waited for so long for the supposed ROI (return of investment),” Foo told a press conference here today.

The victim said two suspects were arrested in Miri and Kuching, remanded briefly and then released.

However, he said there were no further updates from the police regarding his case.

As such, Foo called for a serious and thorough investigation by the police, believing that the alleged perpetrators are still in Sarawak and there may be more victims out there.

He then advised the public to exercise extreme caution when dealing with investment schemes, especially those promising unrealistic, fast or hundred-fold returns.

“The RM750,000 that these victims had invested represented their hard-earned life savings, with some even selling their businesses to participate in this scheme.

“As such, it is hoped that the police would investigate this,” he said.